Which of the Following Provides a Measure of Systematic Risk

Analyzem to analyze previously computed systemic risk measures. The correlations are large and.

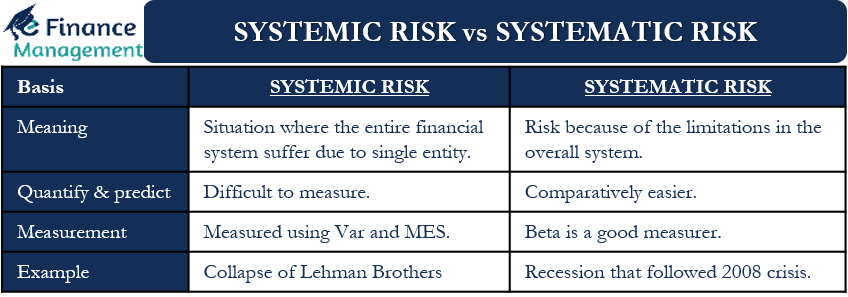

Systematic Risk Learn How To Identify And Calculate Systematic Risk

Datasets must be built following the structure of default ones included in every release of the framework see Datasets folder.

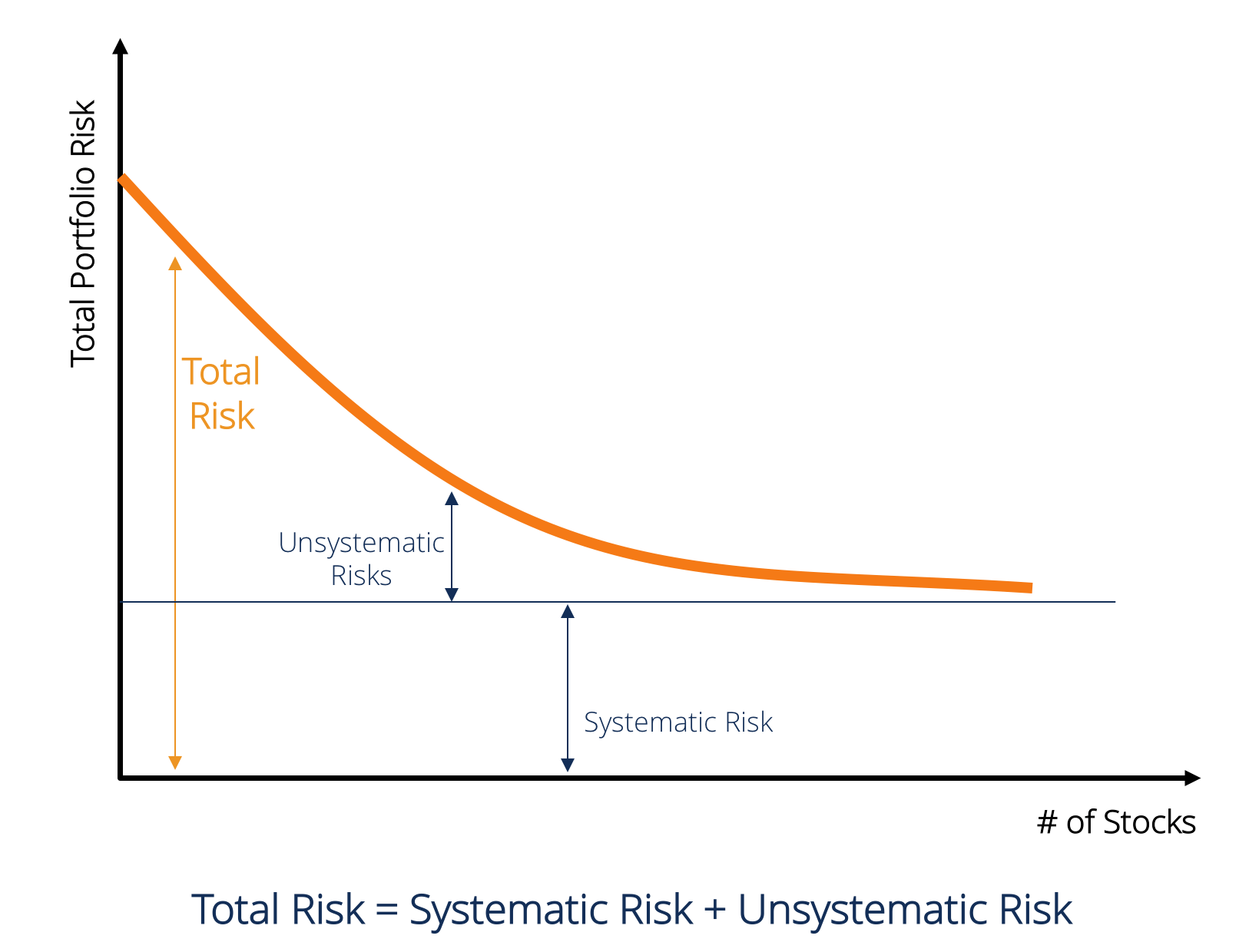

. Hashem Pesaran and Til Schuermann 280. The systematic risk also called market risk Cannot be minimizeddiversifiedeliminated away no matter how many securities you add to your portfolio Total risk Company risk market risk Company specific risk also called Unique Risk Unsystematic. The correct answer was.

Market Risk Market risk is caused by the herd mentality of investors ie. Return of the market portfolio or an appropriate index for the given security such as the S. Systematic risk occurs due to macroeconomic factors.

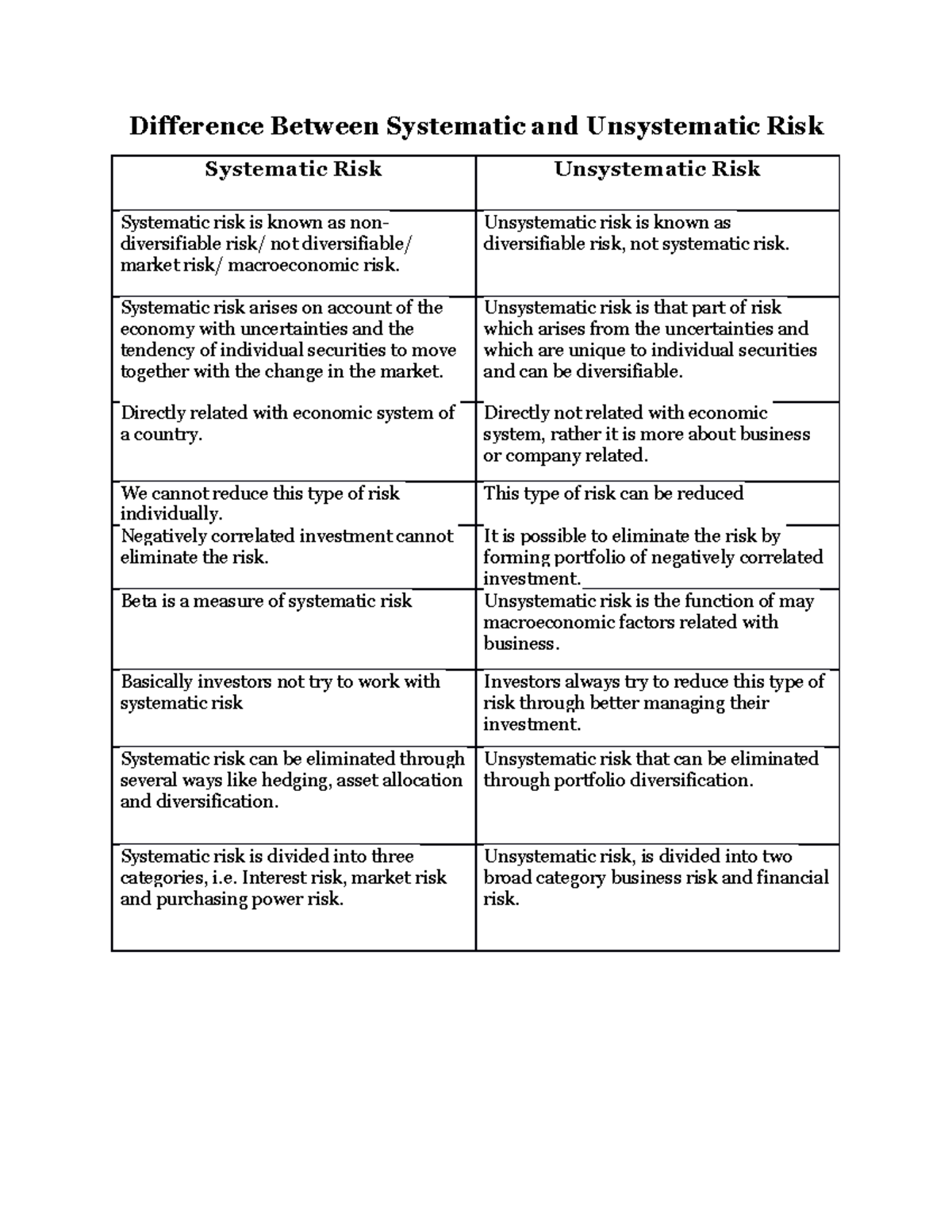

Beta is a measure of unsystematic risk whereas standard deviation is the measure of total risk. Includes GDP inflation interest rates etc Unsystematic Risk unique or asset-specific risk Risk that affects at mostlimited a small number of assets. Market Risk Premium E R Mkt - r f.

Beta is a measure of total risk whereas standard deviation is the measure of systematic risk. The tendency of investors to follow the direction of the market. Mad Cow disease in Montana hurts local ranchers and buyers of beef.

Market Risk Premium The reward investors expect to earn for holding a portfolio with a beta of 1. AL DOHA Company. Below a list of the supported Excel sheets and their respective content.

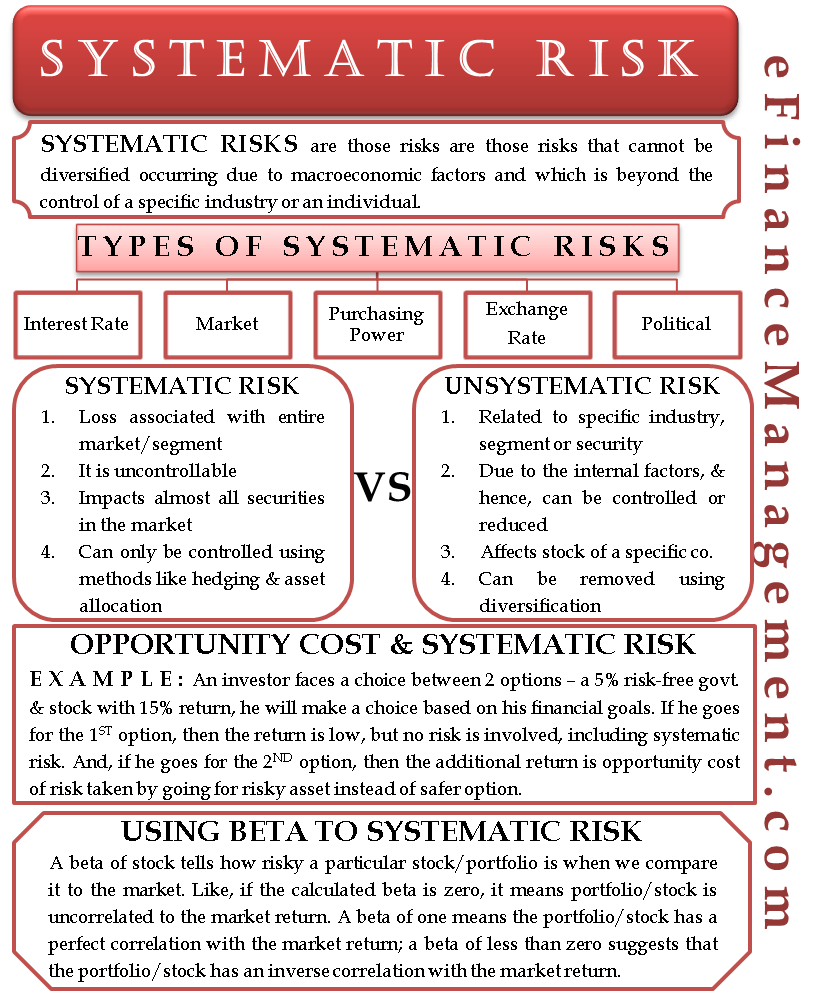

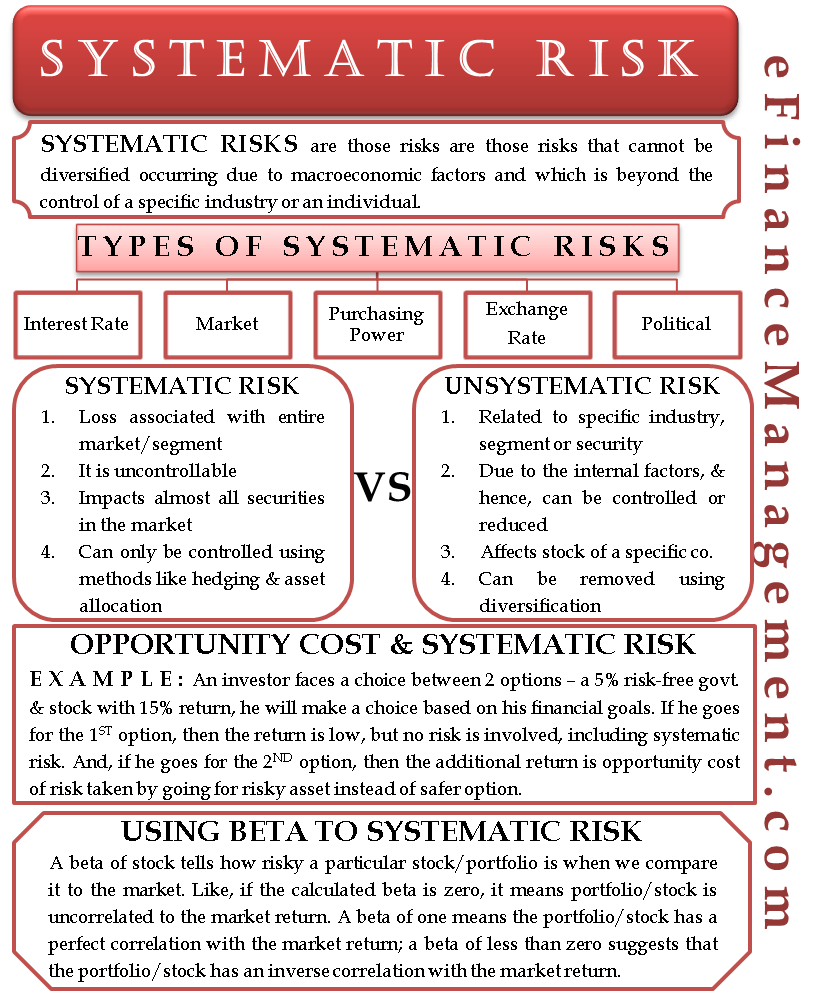

It is used in the capital asset pricing model. A strike by union workers hurts a firms quarterly earnings. - Beta measure the sensitivity of a security to market-wide risk factors.

Systematic risk coefficient of security in comparison to the market. An investor can identify the systematic risk of a particular security fund or portfolio by looking at its beta. Unanticipated events that affect almost all assets.

6 years agoSee more. Risk measurement and systemic risk April 2007 SESSION 5 RISK MEASUREMENT AND MARKET DYNAMICS Bank credit risk common factors and interdependence of credit risk in money markets Naohiko Baba and Shinichi Nishioka 228 Firm heterogeneity and credit risk diversification Samuel G. Beta measures how volatile that investment is compared to the overall market.

One cant eliminate such a risk by holding more number of shares. The systemic risk cube provides a sort of measure. We provide sufficient conditions for two random vectors to be ordered by the proposed CoD-risk measures and ΔCoD-measures.

Runm to perform the computation of systemic risk measures. Types of Systematic Risk Systematic risk includes market risk interest rate risk purchasing power risk and exchange rate risk. Types of systematic risks can include interest rate changes recessions or inflation.

Upvote 2 Downvote 0 Reply 0 Answer added by Deleted user. Downvote 0 Reply 0 Answer added by Emad Mohammed said abdalla ERP IT Software operation general manager. Beta is a measure of total risk whereas standard deviation is the measure of unsystematic risk.

Determining system risks based on triggers origins and impact opens up an avenue for measuring systemic risk. Which one of the following does measure risk. Risk-Free Rate generally the rate of government security or savings deposit rate.

Systematic risk is often calculated with beta which measures the volatility of a stock or portfolio relative. Hence market risk is the tendency of security prices to move together. This beta can be calculated through time-series regression of stock returns to the.

Which of the following provides the best example of a systematic risk event. The Federal Reserve increases interest rates 50 basis points. Panel B of Table 1 provides the correlation across firms between the banks SCAPTier 1 and the banks MES and leverage.

All investments and securities suffer from such type of risk. The SCAP can be considered as close as possible to an ex ante estimate of expected losses of different financial firms in a financial crisis in the spirit of our measure of systemic risk. Global systemic risks of today a new challenge.

Systematic Risk Also called Market risk or non-diversifiable Risk that influences a large number of assets. It is also called market risk or non-diversifiable or volatility risk as it is beyond the control of a specific company or individual and hence cant be diversified. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

Volatility measures total risk systematic plus unsystematic risk while beta is a measure of only systematic risk. Expected Return of the Security. The classes unify and significantly extend existing systemic risk measures such as the conditional Value-at-Risk conditional Expected Shortfall and risk contribution measures in terms of the VaR and ES.

Systematic Risk Meaning Types And How To Measure It

Difference Between Systematic And Unsystematic Risk Unsystematic Risk Is Known As Diversifiable Studocu

No comments for "Which of the Following Provides a Measure of Systematic Risk"

Post a Comment